Stellar (XLM) price has surged over 400% in the last 30 days, marking one of the most significant rallies in November. After reaching $0.63, its highest price since 2021, XLM now faces potential consolidation as its trend indicators show signs of weakening.

Despite this, the uptrend remains intact, supported by strong market interest and bullish sentiment. If XLM can regain its momentum, it may target $0.70 next, continuing its remarkable ascent.

XLM Current Trend Is Losing Its Strength

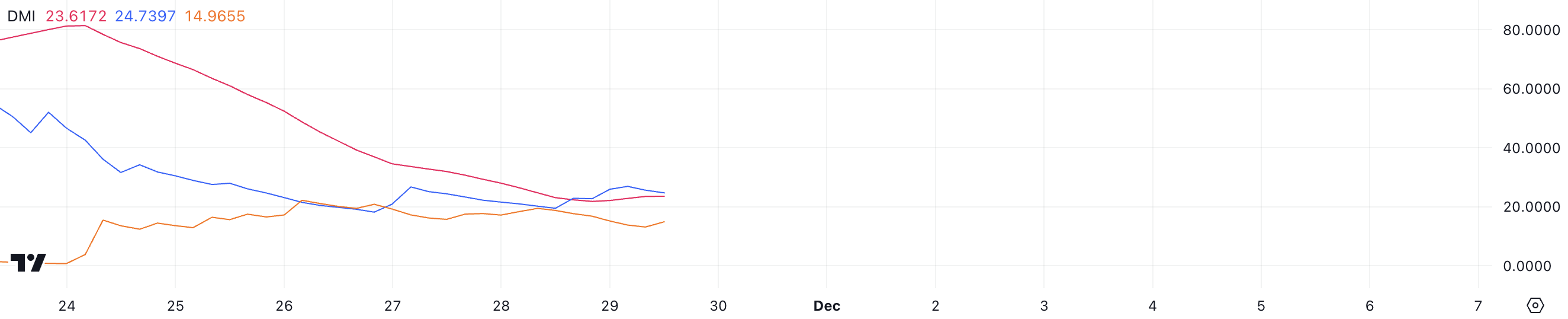

Stellar DMI chart indicates an ADX of 23.6, down significantly from over 40 just two days ago, suggesting weakening trend momentum. The ADX, or Average Directional Index, measures the strength of a trend on a scale of 0 to 100 without indicating its direction. Values above 25 signal a strong trend, while values below 20 suggest a weak or no trend.

Although XLM price remains in an uptrend, the declining ADX reflects diminishing momentum, hinting at potential consolidation or a slowdown in the bullish movement.

With the positive directional indicator (D+) at 24.7 and the negative directional indicator (D-) at 14.9, XLM’s uptrend still shows a clear bullish bias. The higher D+ value highlights that buying pressure is currently outpacing selling pressure, supporting the continuation of the uptrend.

However, for the trend to regain strength, the ADX would need to climb back above 25, signaling stronger momentum. Until then, Stellar price may see more modest gains or a period of consolidation.

Stellar CMF Has Been Negative for 3 Days

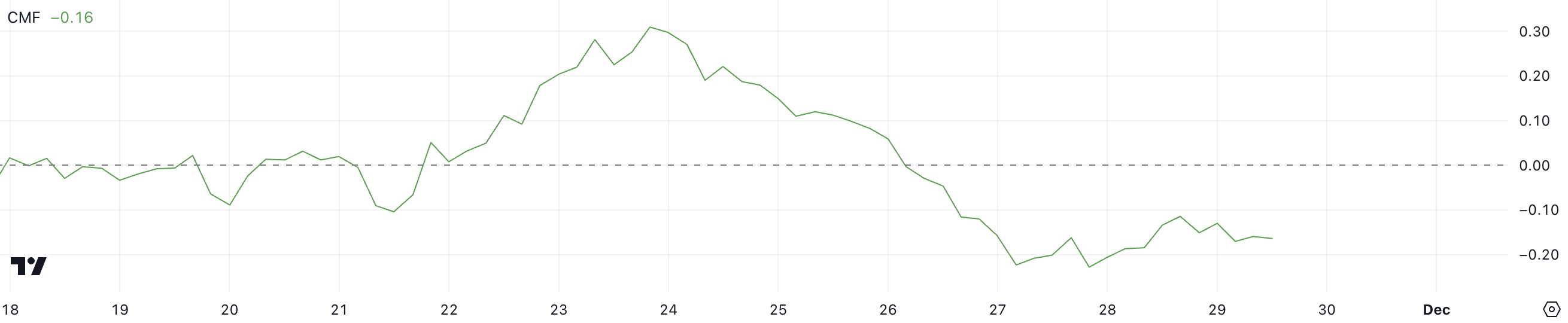

XLM’s CMF currently stands at -0.16, marking a sustained negative trend since November 26 after being positive for four consecutive days. The CMF, or Chaikin Money Flow, measures capital inflows and outflows over a given period, with values above 0 signaling buying pressure and values below 0 indicating selling dominance.

A negative CMF value suggests that selling activity has outweighed buying, which could slow the current uptrend.

At -0.16, Stellar CMF indicates moderate selling pressure, potentially limiting its recent bullish momentum. While this value reflects a shift in sentiment, it remains less severe than more extreme negative levels seen during stronger corrections.

If the CMF trends further downward, it could signal a weakening uptrend and increase the likelihood of a price pullback. Conversely, if it returns to positive territory, it would reaffirm growing buying pressure and support continued price gains.

XLM Price Prediction: Can It Reach $0.7 In December?

Stellar price recently achieved $0.63, its highest price since 2021, showcasing impressive bullish momentum. XLM is up 433.84% in the last 30 days.

If the current uptrend regains strength, XLM price could retest this resistance level and potentially rise to $0.70, representing a 37% increase from current levels.

However, if the uptrend fails to sustain and selling pressure increases, XLM price could face a reversal. In this scenario, the token may test its key support at $0.41, a significant level to maintain its medium-term bullish outlook.

A failure to hold this support could signal a deeper correction and diminish the recent positive momentum.

The post Stellar (XLM) Price Return to $0.70 Could Be Postponed for Now appeared first on BeInCrypto.