Crypto market participants have three US economic data to monitor this week that could influence Bitcoin (BTC) sentiment and cause volatility. The interest comes amid the significant influence of US macroeconomic data on Bitcoin and crypto markets in general this year, after a dried-up period in 2023.

Meanwhile, Bitcoin price remains just shy of $100,000, hovering within the $99,000 range throughout the weekend.

3 US Economic Data That Could Influence Bitcoin Price This Week

This week promises to be very event-rich, with the following US economic data expected to drive volatility in the Bitcoin and altcoin markets.

US CPI

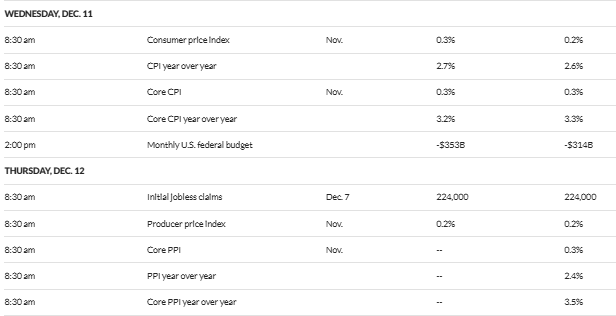

The US CPI (Consumer Price Index) is a key watch among US economic data this week. It is due for release on Wednesday, December 11, at 8:30 A.M. Eastern Time. Released by the US Bureau of Labor Statistics (BLS), this macroeconomic data measures the monthly change in prices paid by consumers, effectively tracking inflation over time.

During the previous US CPI data release, the BLS revealed rising inflation to 2.6%. Specifically, inflation held steady at 0.2%, matching September’s figure. However, the annual increase of 2.6% marked the first uptick in eight months.

This raised speculation of Federal Reserve (Fed) tightening. However, institutional interest in BTC buoyed the value of the pioneer crypto as it continues to appeal as a store of value, thereby attracting demand.

There is a median forecast of 0.3%, which means prices are expected to rise 0.3% on a month-over-month basis, per economist projections. This would be above the 0.2% month-over-month increase in September. There is also a consensus of 2.7% among Wall Street economists.

All eyes will be on the Labor Department this Wednesday as US inflation data comes into focus. In addition to the headline data, the core CPI inflation will also be a key watch this week, offering a more stable reading on inflation because it strips out food and energy prices from the calculation.

Core CPI inflation is of key interest because the prices of goods tend to see sizable and unpredictable changes month to month that have little to do with consumer demand. In November, the core CPI is expected to have risen 3.3% over last year. If it happens this way, it would mark the fourth straight month of a 3.3% reading.

Meanwhile, monthly core price increases are expected at 0.3%, also in line with the October gain.

Due to its decentralized nature and limited supply, Bitcoin is considered a hedge against inflation. On Wednesday, BTC could benefit from a rising trend in US CPI and core CPI.

For the layperson, if investors perceive rising inflation as a threat to the purchasing power of traditional currencies like the US dollar, they may turn to alternative assets like Bitcoin as a store of value. This increased demand could potentially drive up the price of Bitcoin.

Initial Jobless Claims

The US jobless claims report for the week ending December 7 is due for release on Thursday. The data will provide insights into the labor market’s health and overall economic conditions.

Typically, high levels of jobless claims indicate economic distress and uncertainty. On the other hand, low levels suggest a strong job market and economic stability.

For the week ending November 30, applications for unemployment insurance increased to 224,000. This print came in above initial estimates of 215,000. It was also higher than the previous week’s tally of 215,000, revised from 213,000.

According to the BLS employment data, however, the American job market picked up slightly in November. The unemployment rate rose to 4.2%.

Specifically, the US added 227,000 nonfarm payroll (NFP) jobs in November after the labor market faltered in October. This was amid the Boeing strike and Hurricane Milton’s aftermath.

“The latest jobs data says the labor market is still going strong. After the softer numbers in October from the weather and striking workers, November bounces back with strong job growth along with upward revisions. On average, the economy added 173,000 jobs in the last 3 months,” Senior Economist with the Economic Policy Institute Elise Gould shared.

High levels of jobless claims on Thursday may contribute to negative market sentiment and uncertainty. This could lead investors to seek safe-haven assets like gold or Bitcoin. This increased demand for Bitcoin as a store of value could potentially drive up its price.

In the same way, high jobless claims could suggest weakening consumer spending and economic growth. This could influence central banks to implement expansionary monetary policies. Such an outcome may increase concerns about inflation and currency devaluation, prompting investors to turn to alternative assets like Bitcoin to protect their wealth.

US PPI

Also, on Thursday, the BLS will release the Producer Price Index (PPI), a reading on wholesale inflation. The data measures the average change over time in the selling prices received by domestic producers for their output.

The CPI and PPI price data this week will be the main determinant of the Fed’s interest rate decision this month. What the data will show will mark significant milestones in the Fed’s policy adjustment calculus. Of note is that this marks the final week of inflation data before the December Fed meeting.

“All eyes are on CPI and PPI inflation data as markets hope to solidify another 25 bps rate cut,” The Kobeissi Letter said.

Meanwhile, BeInCrypto data shows that markets are down today, with Bitcoin trading for $99,147 as of this writing, a 0.68% decline.

The post Volatility Ahead With 3 US Economic Data Driving Bitcoin Sentiment This Week appeared first on BeInCrypto.