While Bitcoin’s current price of $95,600 is still historically high, the drop from its ATH of $106,800 led to a significant amount of distribution among holders.

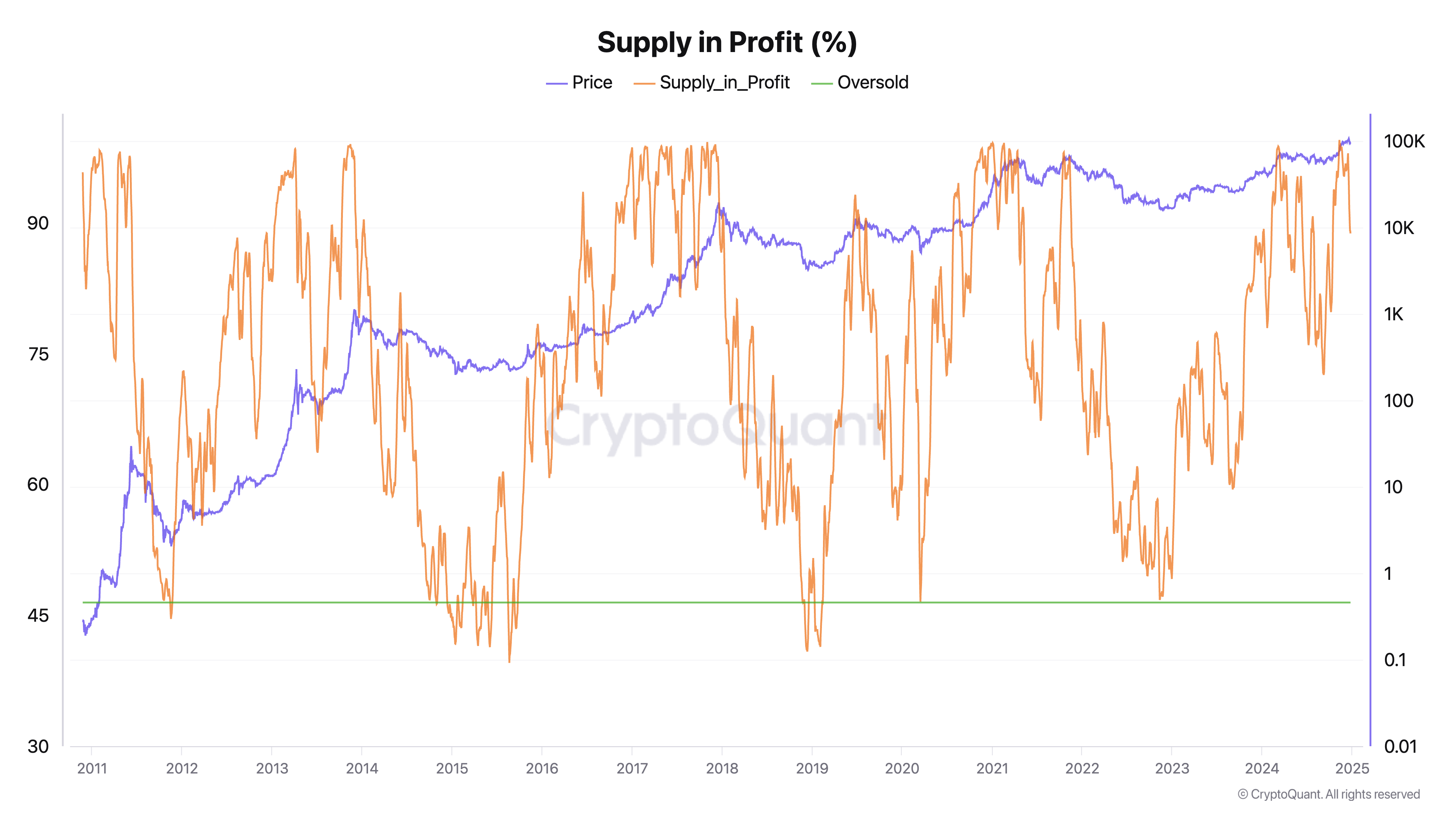

The rally that followed the US Presidential elections in November pushed BTC to $89,000, bringing the total supply in profit to just over 99%. The subsequent increase to $016,800 by Dec. 17 led to a drop in supply in profit to 94.88%. By Christmas Eve, the supply in profit dropped to 88.89% as Bitcoin struggled to remain tied at $95,800.

Despite historically high prices, the decreasing percentage of supply in profit shows that significant distribution is taking place. The drop from 99.09% to 88.89% while prices remained above $95,000 indicates substantial new buying occurred near the peak of around $106,800. This means roughly 11% of Bitcoin’s supply was either bought or last moved at prices above current levels, creating a new cohort of underwater holders.

It also means that these price levels could act as resistance in the near term, as these holders may look to break even on their positions if we see more upward price action.

The rapid decline in profitable supply since mid-December suggests a classic “smart money” distribution pattern to retail investors who often buy near or at local tops. The current percentage of supply in unrealized loss creates potential selling pressure if these new holders become nervous about further price declines. However, such high levels of supply in profit (exceeding 80%) have historically indicated strong overall market health and were an indispensable part of previous bull cycles.

The post Bitcoin’s supply in profit drops to 88% appeared first on CryptoSlate.