- Ethena Labs unveiled a 2025 roadmap featuring Telegram-based payments, Apple Pay integration, and its synthetic stablecoin, sUSDe, simplifying financial services.

- Ethena, now the second-fastest crypto protocol to hit $100M revenue, aims to tap TradFi markets with its synthetic dollar iUSDe.

Ethena Labs is kicking off 2025 with ambitious plans that could reshape the financial sector. On January 3, the blockchain platform unveiled a roadmap featuring Telegram-based payments and savings fueled by its synthetic dollar stablecoin, sUSDe. The strategic move shows Ethena’s focus on simplifying financial services for users.

Central to that vision is a new Telegram app that will allow users to send, spend, and save sUSDe within the messaging platform. With Apple Pay integration, users can seamlessly switch between savings and mobile payments. The plan is part of Ethena’s pivot from a single-asset issuer to an expansive network for on-chain financial innovation.

“Rather than compete directly with payments companies on their own turf, we plan to address the payments and savings tool use case via building a dedicated application on Telegram and within the TON ecosystem,” said Ethena Labs.

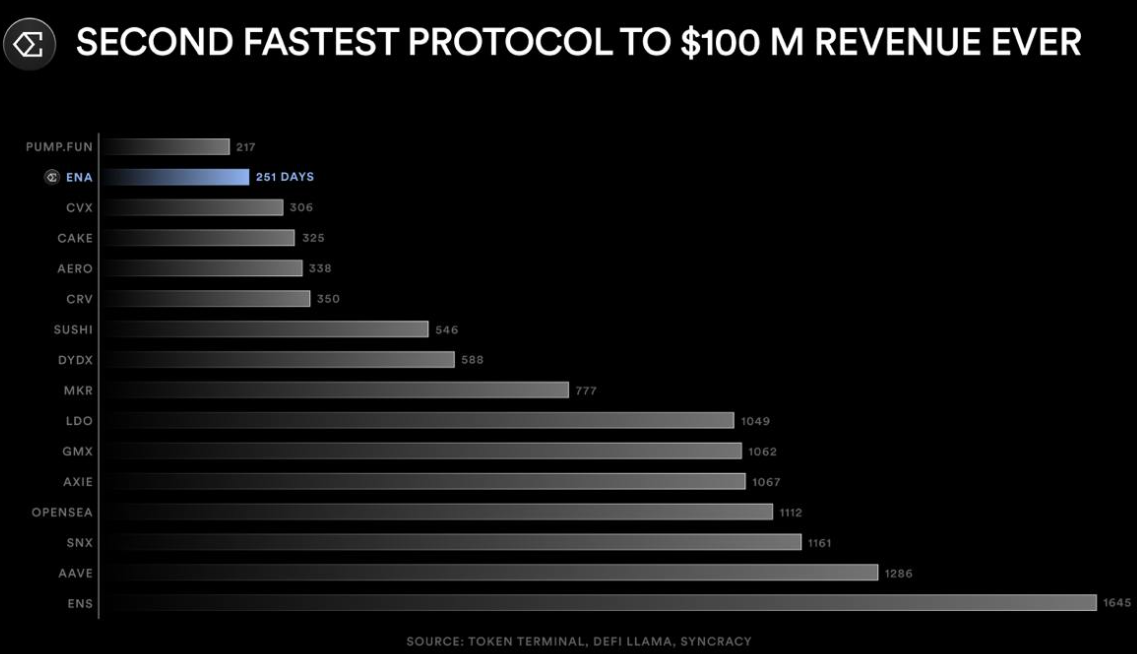

Ethena’s Meteoric Rise—$100M in 251 Days

Ethena has already made waves in the crypto space. The platform became the second-fastest protocol in crypto history to cross $100 million in revenue, achieving the feat in just 251 days. For context, the record-holder, Solana-based Pump.fun, hit that milestone in 217 days.

That growth is bolstered by a steady stream of product launches. In December 2024, Ethena rolled out USDtb, a stablecoin backed 90% by BlackRock’s BUIDL fund, as CNF earlier reported. Unlike its synthetic counterpart, USDtb employs a cash-equivalent reserve model, offering scalable and unrestricted transfers to promote market stability.

Ethena has also built strategic alliances. The company partnered with Trump-backed World Liberty Financial (WLFI), with plans to use sUSDe as collateral for WLFI’s Aave instance if an ongoing governance proposal gains approval.

iUSDe Launches with TradFi Partnerships

Ethena’s first-quarter agenda for 2025 revolves around launching iUSDe, a new product built on its synthetic stablecoin framework. The synthetic dollar will feature token-level transfer restrictions and is designed to attract traditional finance (TradFi) players. The company aims to announce key TradFi partnerships by the end of January.

Targeted at asset managers, private credit funds, exchange-traded products, and prime brokers, iUSDe could tap into the $190 trillion fixed-income market—the largest liquid investment class globally. Ethena’s roadmap stated that demand for a yield-bearing synthetic dollar could dwarf the entire crypto market, including Bitcoin, by “several orders of magnitude.”

And that is why the next logical step for these entities following the ETFs is a dollar savings product. The futures basis is the only market large enough in crypto with the capacity for their level of demand in a dollar format,

February will see the rollout of iUSDe, which Ethena describes as a “simple wrapper contract” for sUSDe. That innovation ties into the company’s broader efforts to develop products powered by stablecoins, such as prediction markets, perpetual products, undercollateralized lending platforms, and even gambling finance.