- Investor excitement around Bitcoin’s ascent to $100,000 has been unexpectedly subdued, with lower-than-expected social media activity.

- Bitcoin’s ability to maintain support above $100,000 is crucial for sustaining its upward trajectory with chances of a possible reversal back to $95,000.

Bitcoin price has been rising steadily over the past week. It broke above the significant benchmark of $100,000 to reach a high of $102,712.49 in the last 24 hours. Currently, BTC price boasts a 6.85% weekly growth, and it shows Bitcoin can bounce back after a long consolidation phase. However, despite this milestone, short-term market behavior remains a concern as some investors start to realize significant profits.

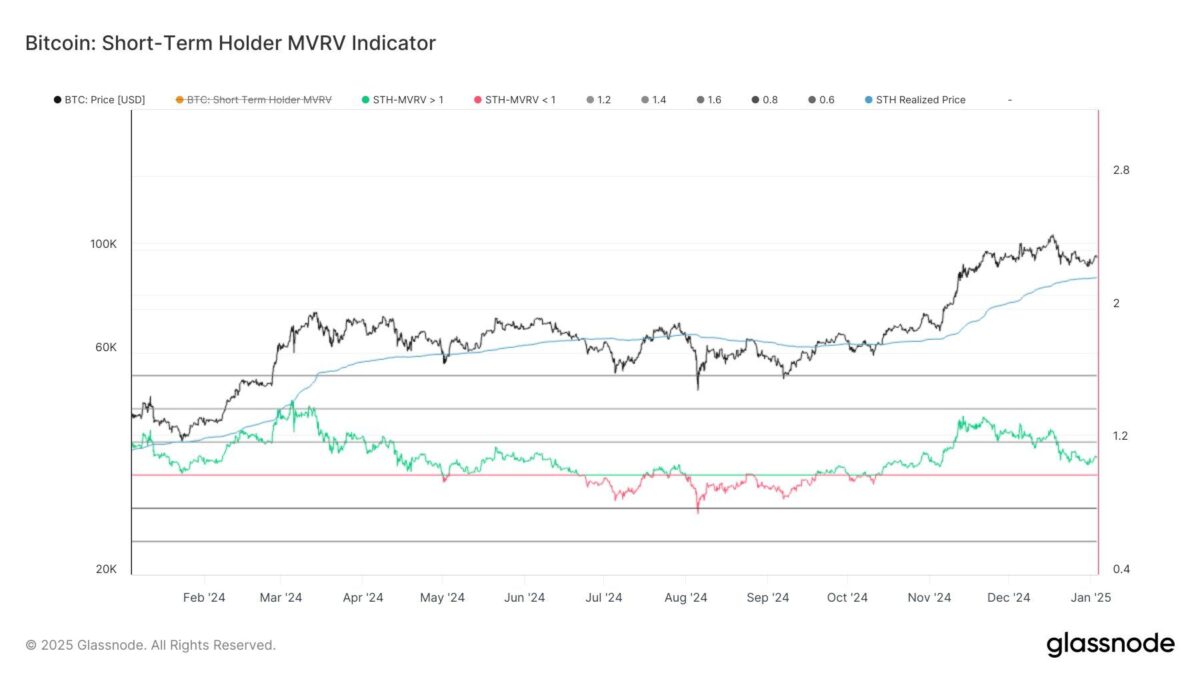

Bitcoin Short-Term Holders Remain Cautious

The Short-Term Holder (STH) MVRV ratio has shown short-term holders starting to realize an average gain of 10%. Historically, such profitability has often led short-term holders to sell out, which might create downward pressure on the market. Long-term holders are still in, but short-term participants are at risk of selling out.

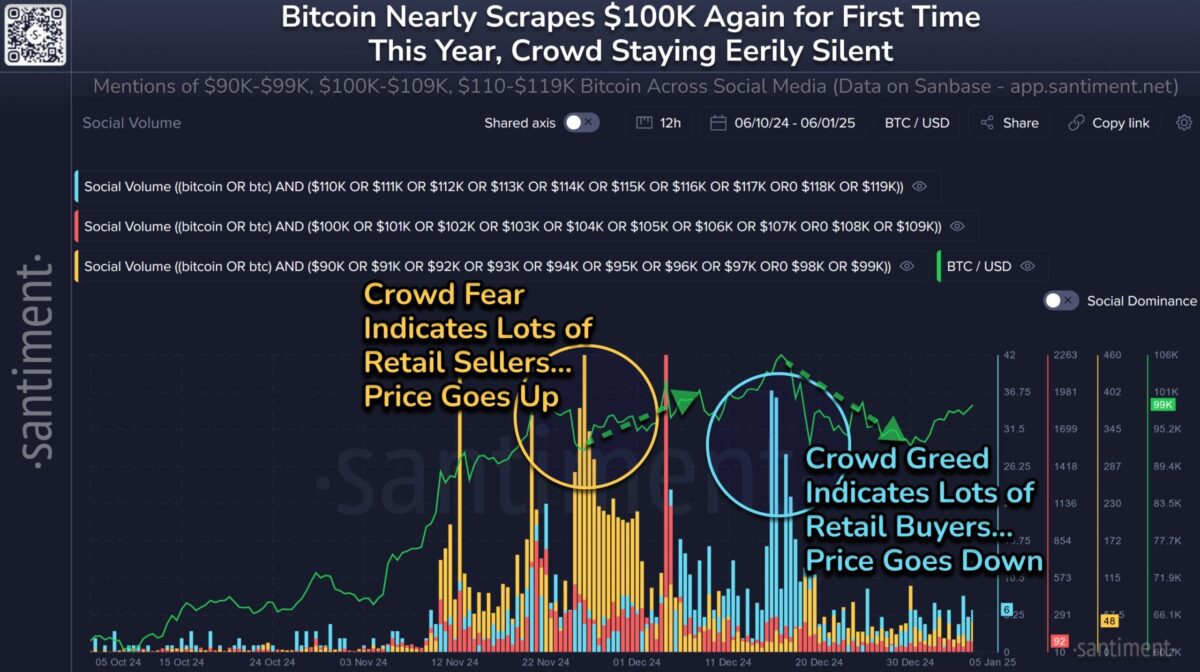

Furthermore, investor responses to Bitcoin price’s ascent to $100,000 have been surprisingly muted. This is quite different from the excitement that normally arises when Bitcoin crosses a significant price level. Previously, movements in the market around psychological thresholds were often accompanied by a high level of activity on social media, as extreme optimism or fear dictated retail behavior.

However, the prevailing environment is actually more balanced in nature. It lacks frenzied buying as well as a panic sell since there is weak sentiment among not only retail investors but also some seasoned investors. This cautious move raises doubts about the potential next move, especially given how BTC has moved so far contrary to its retail crowd expectations. As reported by CNF, Bitcoin price can soar to $120K, with crypto whales building up their positions.

Bitcoin Price Hinges on Significant Support Levels

Bitcoin price’s recent performance keeps it firmly above the $100,000 mark, which can target a price of $105,000 if the price is sustained at that critical level. Holding $100,000 as a stable support zone will be crucial for the continuation of an upward momentum of BTC. In case it does not hold, the BTC price will reverse to $95,668, completely erasing its recent gains and invalidating the bullish scenario.

The general market is still relatively strong and more buoyed by the conviction of long-term investors. However, the actions of short-term traders remain critical to watch. Once these investors book large gains, selling to pressure prices upward over the near term is possible.

As of writing, the BTC price retracted from its high of $102,000 and fell to $100,803.23, gaining 1.41% in the intraday trading. Moreover, the 24-hour trading volume soared 62.86% to $49.47 billion, signaling increased interest among traders.

If the bullish momentum is sustained, Bitcoin price could even reach $250,000 by the end of 2025, according to Standard Chartered’s prediction. In addition, HC Wainwright has raised its BTC price target to a whopping $225,000 for 2025 from an earlier target of $150,000.