Fantom (FTM) is showing mixed signals as it struggles to recover from recent losses. While the price has risen 3% in the last 24 hours, it remains down nearly 20% over the past week, highlighting ongoing challenges in overcoming bearish momentum.

FTM’s difficulties are compounded by broader market uncertainty and a notable drop in whale activity. With the price hovering near critical support levels, its next direction will largely hinge on buyers’ ability to regain control and spark a sustained recovery.

FTM Current Downtrend Is Still Strong

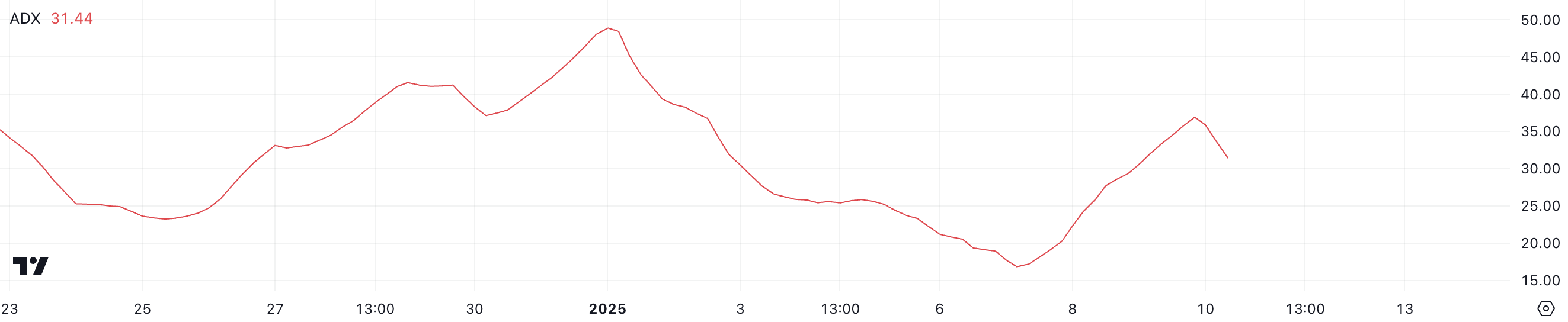

The Average Directional Index (ADX) for Fantom has decreased to 31.4, down from 36.9 one day ago. ADX is a technical indicator that measures the strength of a trend, whether bullish or bearish, on a scale from 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggest weak or absent momentum.

The recent decline in FTM’s ADX reflects a weakening of the previous downtrend, signaling a potential transition to a phase of consolidation rather than continued bearish momentum after FTM price corrected by roughly 20% in the last 7 days.

At its current level, the ADX suggests that while the downtrend’s strength is fading, FTM has yet to establish a clear directional move. This shift could mean reduced volatility and an opportunity for the market to stabilize. If Fantom can maintain this trend, it might signal the beginning of a recovery or range-bound trading.

However, without renewed buying activity or stronger momentum, the price may continue to hover in a consolidation phase, awaiting further catalysts to define its next direction.

FTM Whales Exit Their Positions

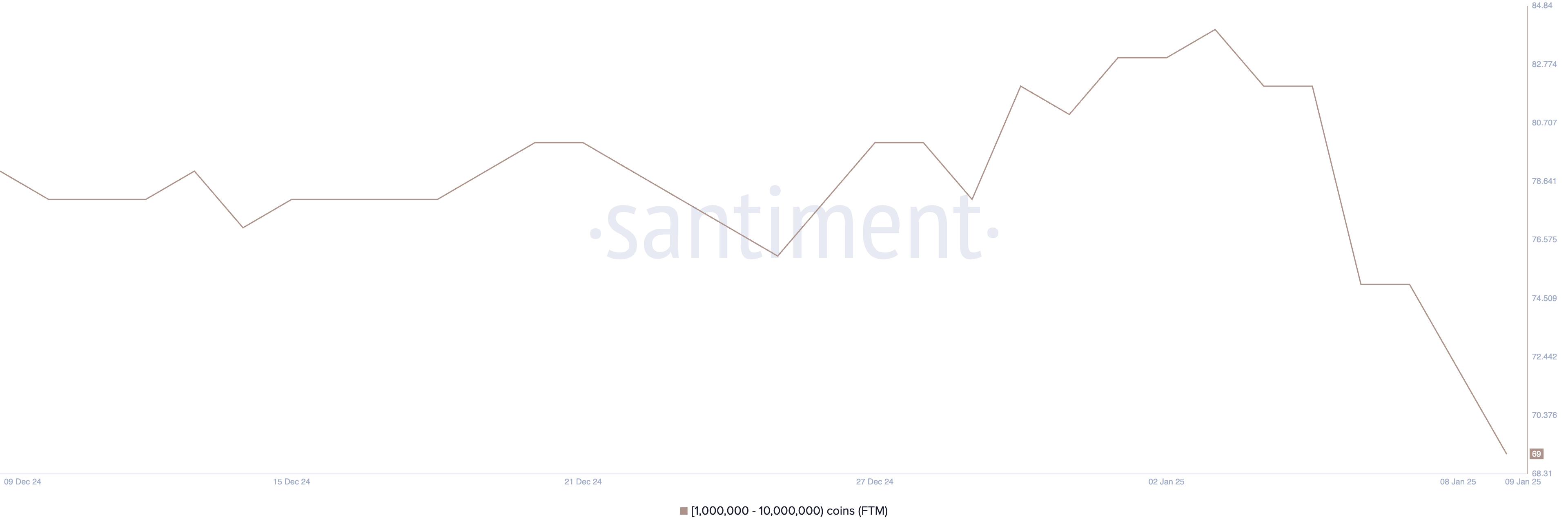

The number of wallets holding between 1 million and 10 million FTM has dropped significantly, falling to 69 from a month-high of 84 on January 3. Tracking the behavior of these so-called whales is crucial, as their large holdings often influence market sentiment and liquidity.

When whales accumulate, it can indicate confidence in an asset, reducing supply and potentially driving prices higher. Conversely, a decline in the number of whales may signal profit-taking, reduced confidence, or liquidation, potentially exerting downward pressure on the price.

This sharp drop in the number of whales within just one week marks the lowest level since November 2024. The decline suggests that major investors have been offloading their holdings, contributing to the selling pressure on FTM price.

Unless whale activity stabilizes or reverses into accumulation, this trend could undermine Fantom price recovery efforts, leaving the price vulnerable to further declines or prolonged consolidation.

Fantom Price Prediction: Can FTM Go Back to $1 In January?

If Fantom price continues its current downtrend, it may test the critical support level at $0.618. A break below this support could intensify selling pressure, potentially pushing FTM price to levels below $0.60 or even as low as $0.50.

On the other hand, a reversal in the trend could pave the way for a recovery, with FTM price aiming to test the resistance at $0.879. Breaking above this level could reignite bullish momentum, allowing the price to climb above $1 for the first time since late December.

If the rally sustains, FTM price might target the $1.05 level, signaling a potential resurgence in investor confidence and a shift back to an uptrend.

The post Fantom (FTM) Climbs 3% While Whale Sell-Off Puts Recovery at Risk appeared first on BeInCrypto.