In traditional finance, assets under management (AUM) are often the most important metric for evaluating investment products. However, Bitwise’s 2025 benchmark survey revealed a departure from this convention in the crypto market — financial advisors prioritize brand reputation and specialized expertise over AUM when selecting crypto investment vehicles.

According to the survey, advisors rank expense ratio (58%) and trading volume/spreads (52%) as their top considerations when choosing Bitcoin ETFs — traditional metrics that align with their fiduciary duty. However, the next most important factors represent a huge shift: brand of issuer (46%) and issuer support (43%) significantly outrank AUM (28%) in importance.

This hierarchy represents a fundamental departure from traditional ETF selection criteria, where AUM often serves as a proxy for product stability and market acceptance. The preference for brand and support over AUM suggests that in crypto markets, expertise carries a premium that outweighs pure scale.

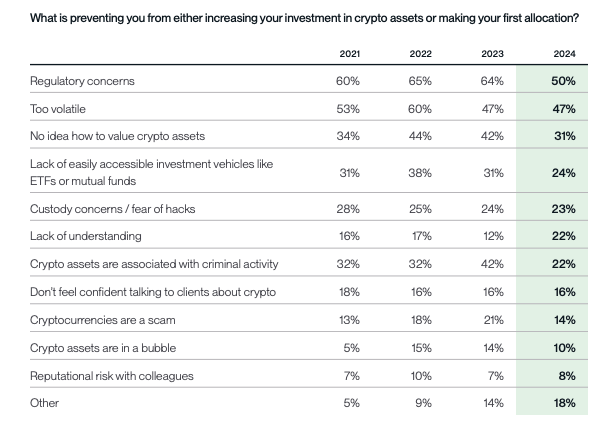

Several factors help explain this phenomenon. Despite growing interest in crypto, significant knowledge gaps remain. The survey reveals that 22% of advisors cite “lack of understanding” as a barrier to crypto investment, while 31% indicate they have “no idea how to value ‘crypto assets.’”

Furthermore, 65% of advisors said they either cannot buy crypto in client accounts or are unsure if they can – showing the critical need for expert guidance in navigating investment opportunities and institutional constraints.

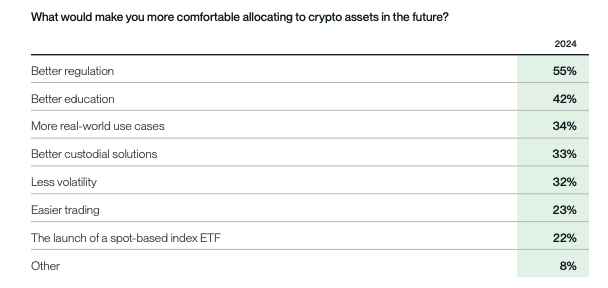

This educational need is further evidenced by the survey finding that 42% of advisors identify “better education” as a key factor that would make them more comfortable allocating to crypto in the future. Only “better regulation” ranks higher at 55%.

The value placed on issuer support (43%) is particularly noteworthy. This encompasses sales support, research, and investor relations – resources that help advisors understand and explain crypto investments to their clients. With 96% of advisors reporting they received questions about crypto from clients in the past year, accessing expert support and educational resources becomes crucial.

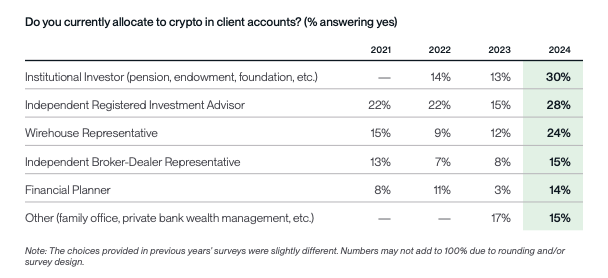

The survey provides interesting insights into how different types of advisors approach crypto. Independent Registered Investment Advisors (RIAs), who represent 44% of survey respondents, show the highest rate of crypto adoption in client accounts at 28%.

This is followed by institutional investors at 30% and wirehouse representatives at 24%. These variations suggest that different segments of the advisory community may value expertise and support in different ways.

This preference for expertise over AUM has significant implications for the competitive landscape in crypto investment products. It suggests that smaller, specialized crypto-native firms can effectively compete with larger traditional financial institutions, provided they can demonstrate deep expertise and provide comprehensive support infrastructure.

The survey data indicates that this expertise-first approach aligns with advisor needs: 99% of advisors who currently allocate to crypto plan to maintain or increase their exposure in 2025. This high retention rate suggests that firms that can effectively combine product offerings with education and support are building lasting relationships with advisors.

The post Brand matters more than AUM in crypto investment products appeared first on CryptoSlate.