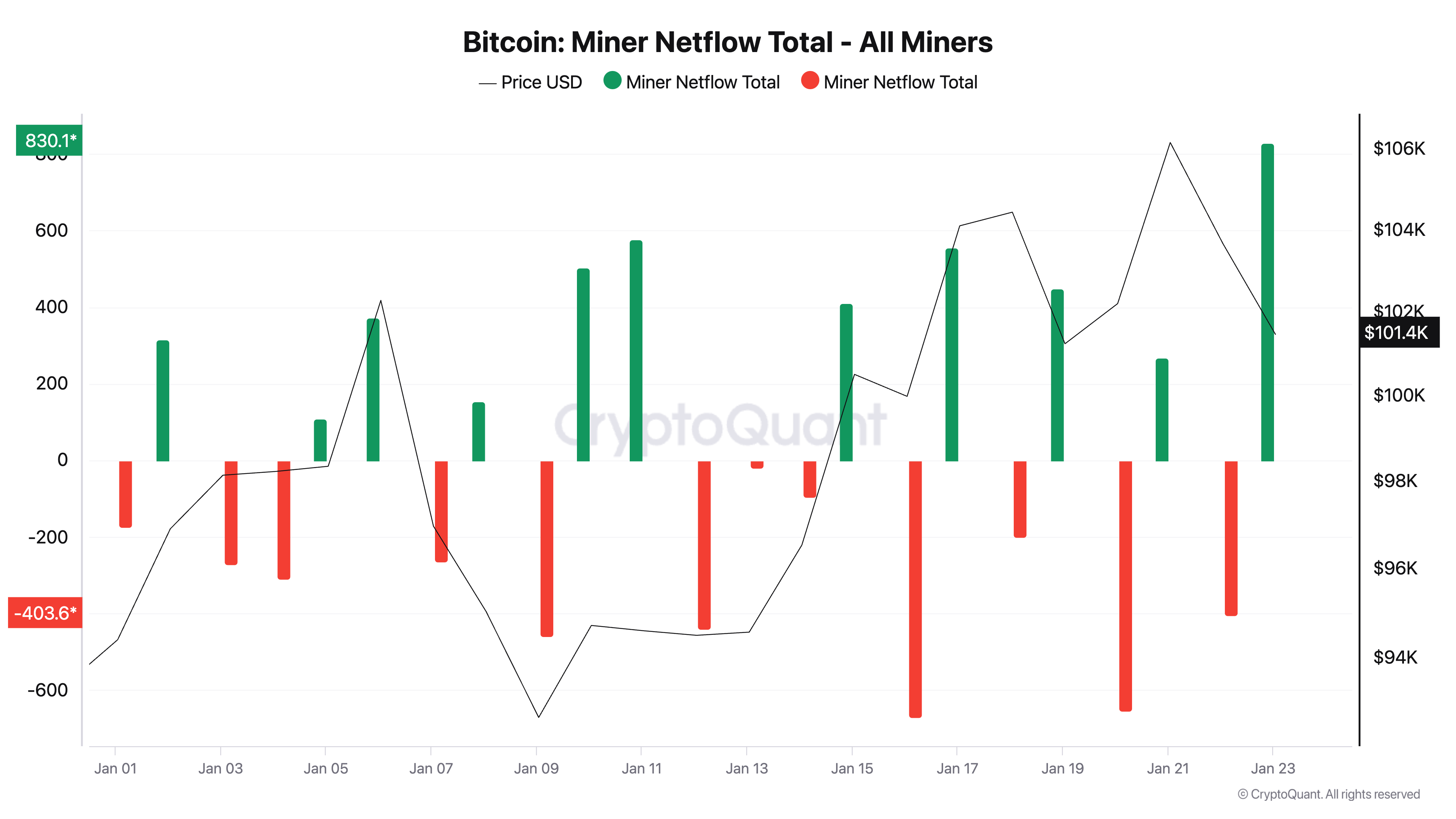

The volatility in the crypto market hasn’t missed the mining industry. Since the beginning of the year, we’ve seen volatility in miner behavior, with alternating periods of accumulation and distribution.

CryptoQuant data showed notable spikes in positive netflow around Jan. 11 and Jan. 23, indicating substantial accumulation during these periods. This accumulation follows Bitcoin’s spike above $100,000, showing that miners saw this as an attractive level for holding rather than selling their Bitcoin reserves.

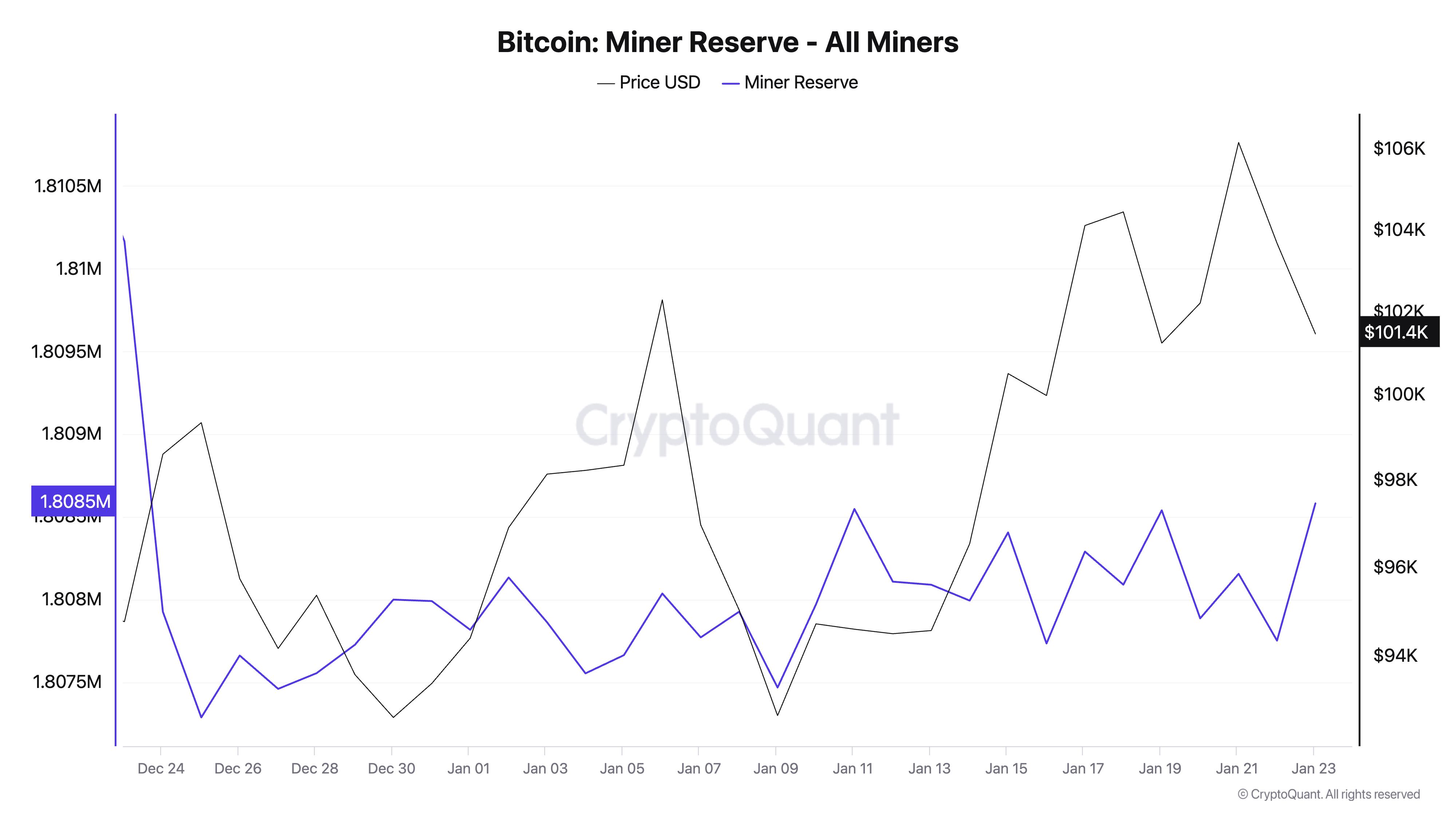

To provide additional context to this accumulation, we have to turn to miner reserve. Data shows relatively stable reserves of around 1.8 million BTC that persisted despite the price volatility we’ve seen throughout January. This stability in reserves, while the price ranged from $94,000 to $106,000, shows miners maintained substantial holdings during this period.

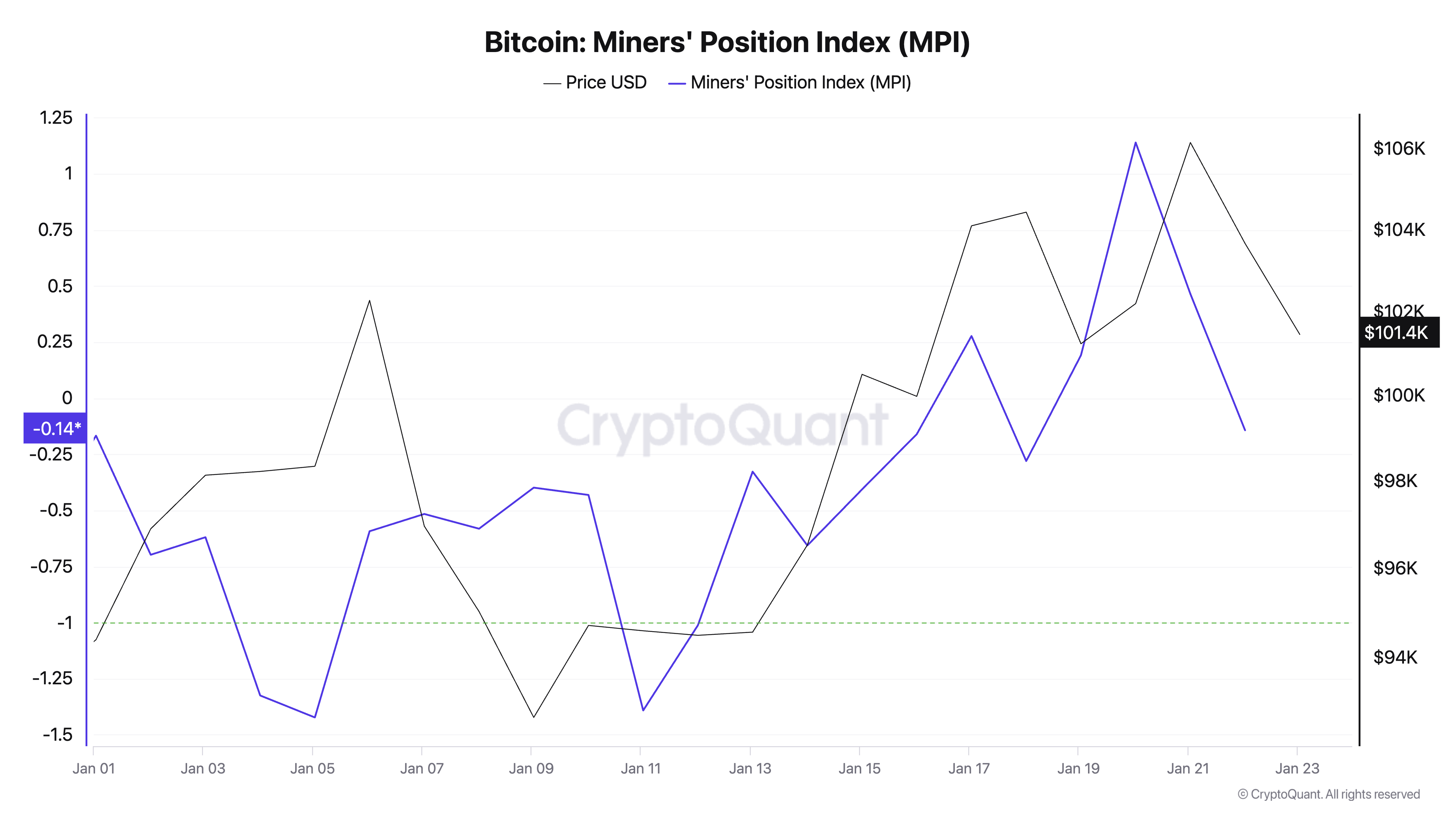

The miner position index (MPI) saw a dramatic shift from negative to positive throughout the month. The Miners’ Position Index (MPI) measures how aggressively Bitcoin miners are selling by comparing their current outflows to their one-year average.

MPI is calculated by dividing the total miner outflow in USD by its one-year moving average. When it goes above 1, it signals that miners are sending more Bitcoin than usual to exchanges, suggesting increased selling pressure. When it’s negative, miners are holding more than their historical pattern.

The MPI started at -0.14 and reached peaks above 1.0 near Jan. 19, showing that miners were sending out significantly more coins than their yearly average. However, despite the increase in selling pressure from miners, Bitcoin’s price remained relatively resilient and maintained levels above $100,000.

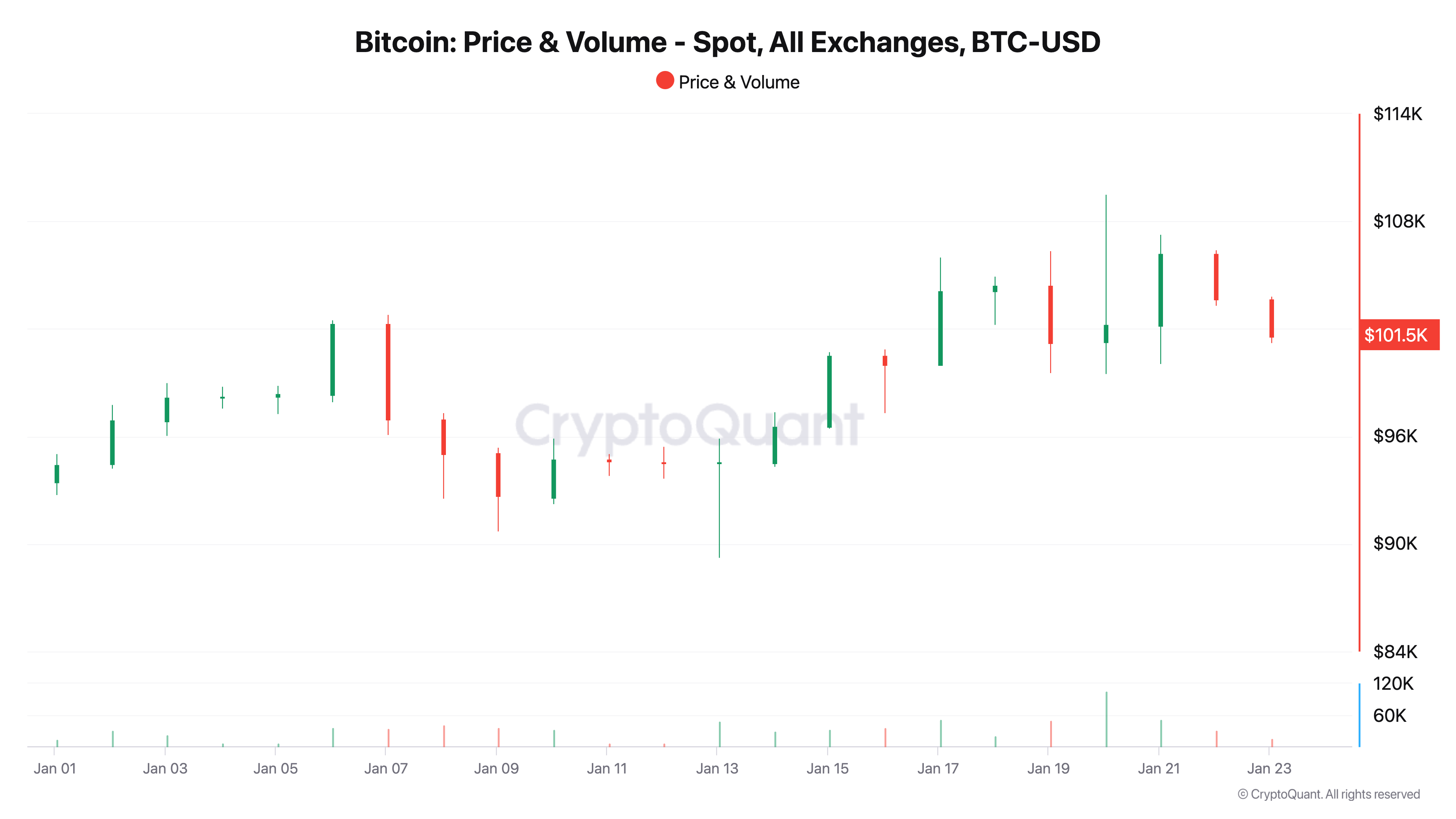

Meanwhile, Bitcoin trading volumes remained relatively consistent throughout the month despite the heightened miner outflows, and price drops were quickly brought up. This suggests strong buyer demand in the market, which offsets the selling pressure from miners.

The data shows that miners have been taking some profits at higher prices while maintaining substantial reserves. This indicates that miners are optimizing operations rather than engaging in distressed selling. The market’s ability to absorb increased miner outflows without a significant effect on price shows robust institutional and retail demand.

This combination of stable miner reserves and resilient price action despite increased selling activity indicates a strong market. The miners’ balanced approach to selling — maintaining significant reserves while gradually distributing holdings at higher prices — shows that the market is steadily absorbing new supply.

The post Miners maintain strong reserve despite strategic selling appeared first on CryptoSlate.