- Key Uniswap upgrades include a “singleton” liquidity model aimed at improving transaction speeds and reducing gas costs, customizable “hooks” for enhanced functionality.

- This version builds on v3’s capital efficiency, introducing a new liquidity model and greater modularity for developers.

Uniswap Labs confirmed it will roll out its much-anticipated version 4 (v4) protocol gradually this week. The deployment will indeed test those central features, including hooks and integrations with other chains, so that developers can run through these tests before the full launch next week. The company posted its update on X, saying: “We expect all contracts to be deployed for a full launch next week”.

A Look At Key Features Of Uniswap v4

Uniswap v4 introduces meaningful upgrades while building upon the capital efficiency gains achieved in v3. One of the most impactful changes in v4 is the liquidity model implemented through a “singleton.” This architecture consolidates liquidity into a single smart contract that is expected to enhance transaction speeds, lower gas costs, and improve the overall user experience.

v4 deployments will begin rolling out this week for builders to test hooks and integrations onchain

We expect all contracts to be deployed for a full launch next week

DeFi renaissance in progress, contract addresses will be shared soon

— Uniswap Labs

(@Uniswap) January 21, 2025

Another major addition in v4 is its increased modularity, with the introduction of “hooks” as a key feature. These hooks are customizable contracts that can be integrated with Uniswap to enable developers to modify and extend the functionalities of liquidity pools. This added flexibility aims to expand the protocol’s use cases and development potential, as previously reported by CNF.

Additionally, in Uniswap v4 a new “flash accounting” will be implemented-replacing the paradigm applied in v3. In Uniswap v3, as with all variants, assets move in and out from the liquidity pool following every transaction, thereby raising associated costs of operations. Flash accounting will only involve moving the different balances of those transactions.

Although the v4 launch was slated for 2024, its release had been delayed by stringent code audits and security competitions. These measures were taken to ensure the robustness and security of the protocol before v4’s release.

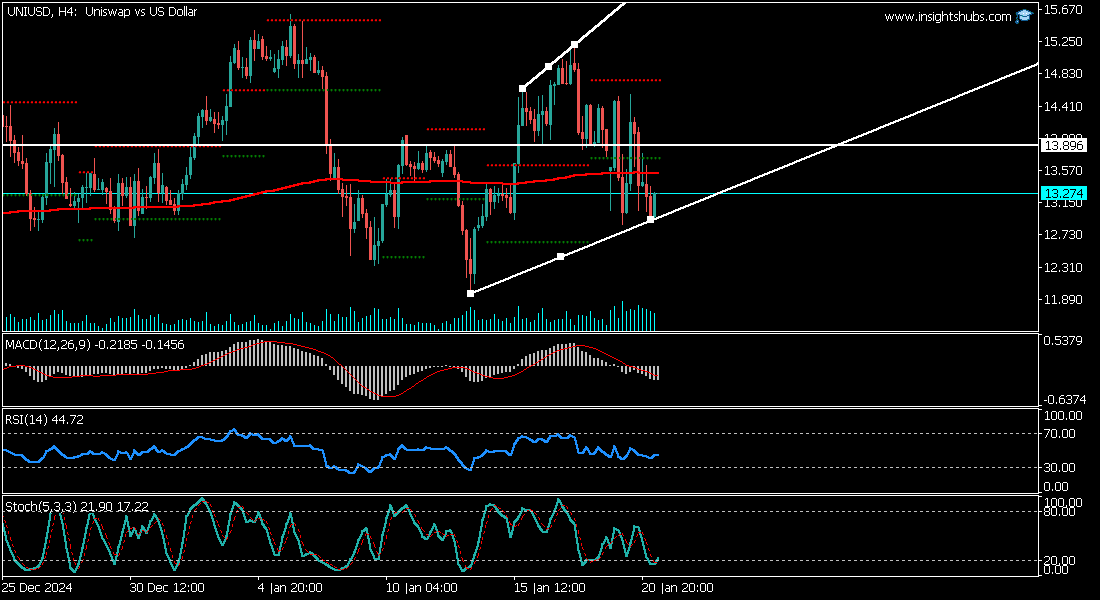

UNI Price Action Today

However, Uniswap’s native token, UNI, is struggling with significant losses owing to the broader market volatility after President Donald Trump’s Inauguration Day on Monday. As of writing, the UNI price dropped by 1.55% to $13.39 on Wednesday, January 21. Nonetheless, Uniswap token’s weekly gains stood at 2.95%.

Whilst, the UNI open interest dipped 0.79% to $195.4 million, according to Coinalyze data. Today, crypto analyst Thomas Anderson highlighted a potential bearish move in the market, analyzing the 4-hour chart. He noted, “Price is testing key resistance at 13.996,” while pointing to bearish momentum indicated by a declining MACD histogram.

Anderson also emphasized the relative strength index (RSI) at 44.72, suggesting “room for downside.” Based on these indicators, he predicted a “65% probability of a move down to 13.150 support.” The analysis highlights growing caution among traders, as technical signals hint at further downside pressure in the short term.